The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with taxable income over 10 million. Rentals property management and post-sales service fully integrating buyers to an extensive network of.

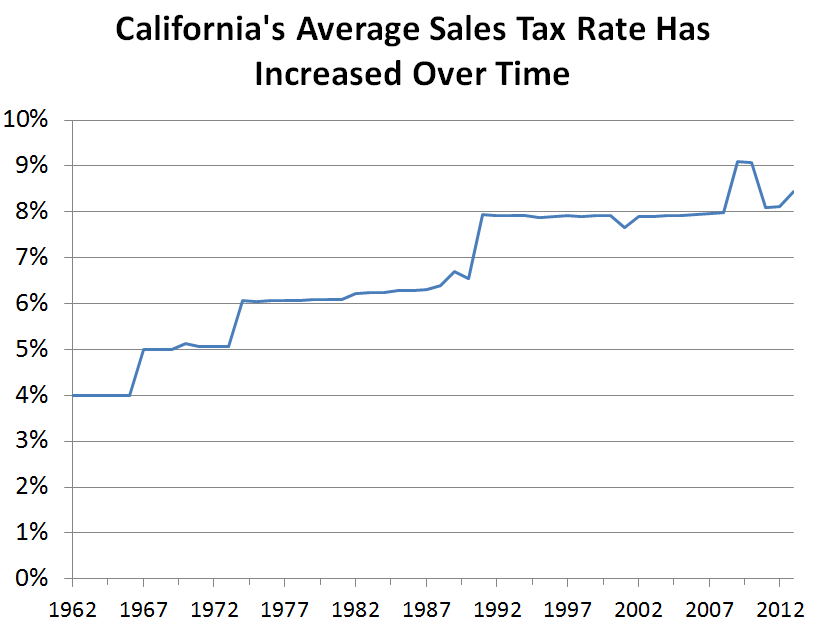

Understanding California S Sales Tax

Tax and Scavenger Sales Foreign Language Brochures.

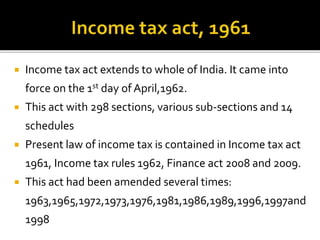

. In this section approved gratuity fund will mean the same as in clause 5 of section 2 of the Income Tax Act 1961. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate. Facilities Under The Sales Tax Act 1972.

Rules Income Tax Rules. Direct Taxes Code 2010 Bill No. Learn more about payment of gratuity act its rules calculation Benefits of Gratuity Act taxation and other details.

1985 as amended Sections 4 and 5 of Executive Order No. Sales tax in Malaysia is a single-stage tax imposed at the manufactures level. 1985 insofar as the VAT tax exemption and tax credit is concerned.

By the late 1990s the term Tobin tax was being applied to all forms of. Rentals property management and post-sales service fully integrating buyers to an extensive network of 500 partner real estate developers 150000 Agents. Income Tax Department Direct Tax Vivad Se Vishwas Act.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. 89-123 changed the chapter title from Sales and Use Tax Act to Sales and Use Taxes Act. In the case of locally manufactured taxable goods sales tax is levied and charge on the finished goods when such finished goods are sold or disposed of.

And a law degree at Chicago-Kent College of Law at the Illinois Institute of Technology in 1982. A doctorate in Counseling and Psychology at Loyola University of Chicago in 1976. A degree in Guidance and Counseling at West Virginia University in Morgantown in 1972.

Section 3 of Presidential Decree PD. West Virginia in 1970. Increase in Standard Deduction and Personal.

1972 act increased tax rate to 7 deleted provisions re appropriations to development. Other Direct Tax Rules. The raw material or components use in the manufacture of taxable.

99-841 Tax Reform Act of 1986 - Specifies that the Internal Revenue Code shall be cited as the Internal Revenue Code of 1986 Title I. Circulars Notifications. The existing tax-free maximum amount of Gratuity will be increased to 30 lakhs.

7291 or An Act Restoring the Tax and Duty Incentives. Section 3 of the Gratuity Act 1972- Controlling Authority. Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals corporations trusts and othersTax evasion often entails the deliberate misrepresentation of the taxpayers affairs to the tax authorities to reduce the taxpayers tax liability and it includes dishonest tax reporting declaring less income profits or gains than the amounts actually earned overstating.

73-288 changed name of act from Education Welfare and Public Health Tax Act to Sales and Use Tax Act. Imposition of the General Excise Tax on Sales of Tangible Personal Property to National Banks and Federal Credit Unions and the Exemption from the Use Tax on the. Learn about income tax act 1961 in India.

Individual Income Tax Provisions - Subtitle A. No sales or use tax applies to the transfer of title to or the lease of tangible personal property pursuant to an acquisition sale and leaseback which is a transaction satisfying all of the following conditions. The sellerlessee has paid California sales tax reimbursement or use tax with respect to that persons purchase of the property.

Stamp Tax on Sales Agreements to Sell. 110 of 2010 Direct Taxes Code 2013. One Hundred Dollars 100 General Income Tax credit Act 231 SLH 1981.

For tax years beginning after 2017 the Tax Cuts and Jobs Act PL. Reprints of Hawaii Tax Laws as Administered by the Department of Taxation. It is the act which gives a clear explanation about IT sections under the act and schedules to the act.

A Tobin tax was originally defined as a tax on all spot conversions of one currency into another. TDS on Salary TDS Return Due Date Form 16 Form 26AS Form 15G and 15H Section 80C Section 80DD Section 80D Road Tax Service Tax Sales Tax Excise Duty Property Tax BBMP Property Tax Karnataka Road. It was suggested by James Tobin an economist who won the Nobel Memorial Prize in Economic SciencesTobins tax was originally intended to penalize short-term financial round-trip excursions into another currency.

1985 and Section 4 of EO. Budget and Bills Finance Acts. What is Gratuity Act 1972.

Conference report filed in House 09181986 Conference report filed in House H.

Unit4 Income And Sales Tax Act

Understanding California S Sales Tax

Unit4 Income And Sales Tax Act

Unit4 Income And Sales Tax Act

Understanding California S Sales Tax

California S Sales Tax Rate Has Grown Over Time Econtax Blog

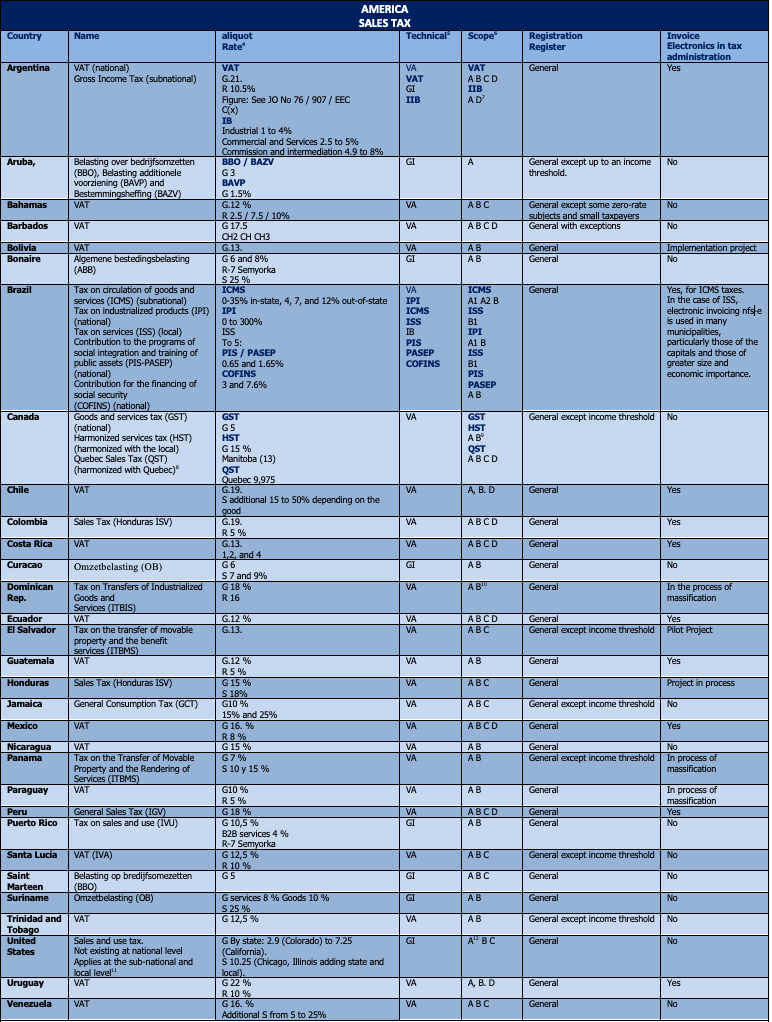

Value Added Tax Its Application In America Inter American Center Of Tax Administrations

Unit4 Income And Sales Tax Act

Unit4 Income And Sales Tax Act

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)